Get in touch

555-555-5555

mymail@mailservice.com

Blog

By Jason Pacheco

•

01 Apr, 2024

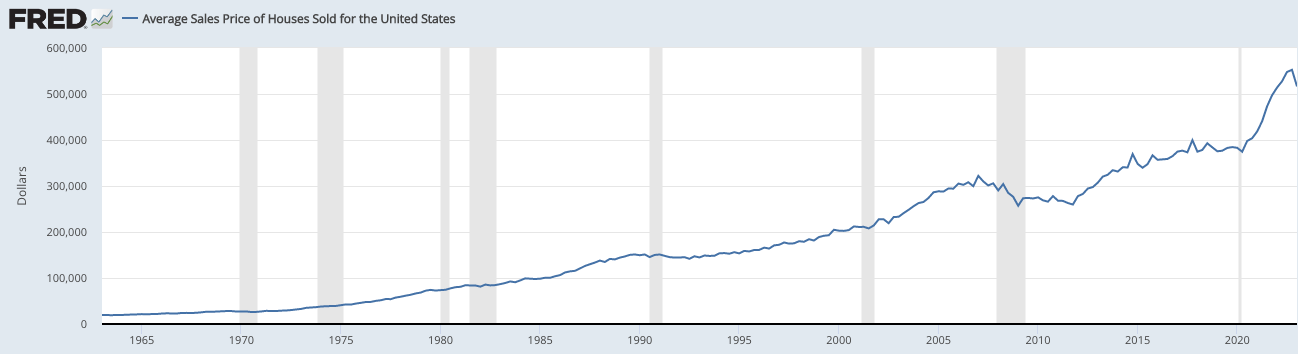

A question that frequently comes my way is, " When do you anticipate prices will come down ?" It's a valid concern, especially considering historical data. Since 1960, prices have only experienced a significant decline once, largely attributable to poor lending practices. Over the past 60 years, we've seen prices decrease noticeably only on that one occasion. Given this historical trajectory, with roughly 16 years having passed since the last substantial price reduction, it's pertinent to question the likelihood of it occurring again in such a short timeframe. In my view, the odds of prices dropping significantly within the next 2-3 years seem slim (b arring any unforeseen economic events). Factors such as the persistently low inventory and the relentless demand for housing paint a picture of a market resistant to price decreases. To put it simply, housing has become a necessity akin to toilet paper. Just as a shortage of toilet paper on store shelves leads to competitive purchasing behavior and even higher prices, the real estate market faces a similar scenario. With a surplus of buyers and a scarcity of available properties, competition naturally drives prices up. Furthermore, any decrease in interest rates is likely to exacerbate the situation, drawing even more prospective buyers into the market without a corresponding increase in housing supply. This influx of buyers only intensifies the competition for limited inventory, potentially leading to further price escalation. In essence, the dynamics of supply and demand, coupled with the influence of interest rates, create a scenario where significant price reductions in the housing market appear unlikely in the foreseeable future . Jason Pacheco, Jason.Pachecohomes@gmail.com

By John Gesualdi

•

20 Mar, 2024

Buying a home is one of the biggest investments you will make in your lifetime. It’s an exciting but often overwhelming process, especially for first-time homebuyers. If you’re considering purchasing your first home, you may be wondering whether or not you need a buyer’s agent. The answer is yes! In fact, according to a recent report by the National Association of Realtors, 88% of home purchases in Rhode Island involved a buyer's agent. One reason why you should consider using a buyer’s agent is that a listing agent’s primary responsibility is to negotiate the best deal for the seller. While they must treat all parties fairly, their ultimate goal is to get the highest price and best terms for their client. This means that as a buyer, you may not get the best deal if you place your offer through the listing agent. On the other hand, a buyer’s agent is solely focused on representing the buyer’s interests. Their job is to negotiate in the buyer’s best interest and properly draw up real estate contracts. They use their expertise and market knowledge to help you navigate the complex home buying process and find the best property for your needs and budget. A buyer's agent will also help you understand the real value of the home you are interested in, whether you are overpaying or getting a good deal. Another benefit of using a buyer’s agent is that they can help you save time and money. With access to the Multiple Listing Service (MLS), a buyer's agent can filter through properties that don't meet your criteria, saving you time and effort. They can also help you negotiate a better deal, ensuring you get the best possible price and terms. Additionally, a buyer's agent can help you navigate the mortgage process, making sure you find the right lender and get the best financing options available. When it comes to buying a home, it's important to have an experienced professional on your side. A buyer’s agent can provide valuable support and guidance throughout the entire process, from searching for the right property to closing the deal. They can help you make informed decisions and avoid common pitfalls, ensuring a stress-free and successful home buying experience. In conclusion, if you’re a first-time homebuyer, don’t go it alone. Consider hiring a buyer’s agent to help you navigate the complex home buying process and find the best possible property for your needs and budget. With 88% of home purchases in Rhode Island involving a buyer's agent, it's clear that many homebuyers recognize the value of having a professional on their side. Remember, a buyer’s agent is solely focused on representing your interests and negotiating in your best interest, so you can get the best deal possible. Wri tten By: John Gesualdi // John.Gesualdi@cbrealty.com

By Jason Pacheco

•

04 Jan, 2024

I'm hearing that interest rates are expected to come down, possibly landing in the high 5s or low 6s. The assumption might be that as rates decrease, monthly payments would follow suit. However, it's important to note that purchase prices also play a significant role in determining monthly payments. Are prices projected to decrease? No. So, what influences purchase prices? The answer lies in the dynamics of supply and demand. As interest rates drop, the demand for houses tends to rise. When there's high demand for a particular item, competition intensifies, leading to price increases if the supply isn't sufficient to meet the demand. Let's look at the current inventory as of January 4, 2024: Single Family Homes: 787 Multi-Family Homes: 177 Condos: 200 These figures highlight a glaring lack of inventory, and it's essential to recognize that the current inventory isn't robust enough to support the anticipated decrease in interest rates. This situation may result in prices escalating further throughout the year. What does this mean for your individual housing situation? I encourage you to reach out, and let's schedule a discussion. Here's to a successful housing journey in 2024! Cheers. Jason Pacheco Jason.Pacheco@CBrealty.com 401-808-0673 Pacheco Homes Team Coldwell Banker Realty Broker Associate // Team Leader

By Jason Pacheco

•

09 May, 2023

TOOL BOX Enter the tool box, and grab what tools work for you and apply it to your next offer! Get your pre approval letter updated, and dated, and addressed to the property you’re placing an offer on. The reason being is, the seller wants to see the day they are reviewing offers that your file has recently been looked at, and that you’re pre approved to purchase their home specifically. Also, your pre approval letter will hold more weight if there's a local bank/lender on the letter. Make sure your deposit is at least 1.5% of the offer amount. The closer you can go toward 3%, the better… Keep in mind this amount will go toward the amount due at closing anyway. Type of financing carries weight too. The more % you are putting down as a downpayment, the stronger the offer looks to a seller. What this means is, the more money you have to borrow from the bank, the less your offer will compare when comparing your offer to multiple others. So, try and put a good chunk of money down if you can.. 5%+ *TIP, try and have the word “Conventional Loan” on your pre approval letter. IF YOU CAN, this is more preferred from the sellers point of view. Inspections Inspections Inspections… This one is tough. The way the traditional purchase and sales agreement in Rhode Island is written. If there is something as tiny as 1 light bulb found in the inspection report that is not working, then the buyer will be able to back out, or ask for price reductions, repairs, or credits. Now, put yourself in the seller's shoes. Again, it’s a sellers market. They have multiple offers to pick from. If the sellers receive an offer where the buyers choose to completely waive their rights to inspect entirely, this offer compared to someone having a traditional home inspection (at times) adds about 20K+ more value to the offer. That being said, sellers are going to accept an offer that is $20,000 less than yours, if the buyer is waiving their inspections. The reason is, they don't have to worry about the deal falling apart after they accept and take it off the market, or the buyers asking for big price reductions due to findings on the report. The 10 day home inspection period is the MAIN reason a house will go back on the market. If you were a seller, wouldn't you take a less offer and just be done with it and be over the hurdle? That ALL being said; truthfully, the home inspection period is way too easy for a buyer to be able to back out, or renegotiate. ALSO - its a sellers market! Sellers are getting multiple offers, we have to be DIFFERENT and stand out. Here is how….Agree to waive your rights to terminate the agreement, and the rights to your deposit back due to the inspection; UNLESS, there is 1/single item needing repairs that are greater than $____________. **This is NOT add up 5 items on the report to = the number in the ________ spot. Make sense? I mean you like the house and want to purchase the house, so why would you want to back out if there is a fix needed that would cost you $500.00 when you move in? You’re not purchasing a new construction home, every home needs some sort of work, that is part of homeownership. FYI inspection reports on average are like 6-12 pages long worth of suggested repairs, no home in perfect! So, let's get creative in this competitive market and stand out! Appraisals! This is a tricky one, the easiest way to explain this is with an example... Example: List price: 200,000 /// Your offer gets accepted at 275,000! The bank will hire an appraiser to go to the property to make sure the home is worth 275,000 before they lend you a mortgage to purchase. Lets say the appraiser goes to property and says the home is only worth 220,000. In this case, you will only get a mortgage based on 220,000; BUT, we are telling the seller we will pay 275,000. How are you going to come up with an additional 55,000?! You told the sellers you would? Didnt you? Well - what happens here is the buyers will typically ask for a price reduction to the appraised value because they cannot afford to purchase the home any longer. The sellers DO NOT have to say yes, and they can put their house back on the market. THAT BEING SAID, when you are offering way over list price on these homes trying to be competitive, sellers see right through these offers. They know at some point the house won't appraise and they won't get the full amount you first told them. ***HERE is how we can get creative to get our offer accepted… If you said, “Buyers agree to cover the first $10,000 a potential appraisal gap that may come up, and the sellers will price reduce the rest in the event the property does not appraise”. This way you’re standing out! The way the math typically works here basing it off our example above: 5% down on appraised value (220K) = 11,000 down + 10,000 gap = 21,000 to the table and seller price reduces the rest.. Make sense? Do you need to sell anything to purchase? Do you need the funds from the home you’re living in to purchase the next home? Do you HAVE to put “subject to the buyers selling their home on 123, Main St? *Try and see if you can borrow $$ from someone and pay them back after you sell your home… Can you add a Co-signer? Can you place an offer on the house you want to purchase, and push the closing date out 60+ days to give yourself enough time to sell your current home without the other party finding out? This market is bananas, I sympathize with all my buyer clients during these crazy times. Continue to stay patient, and persistent! Keep in mind, The more offers you make, the more of a chance that one of the homes you placed an offer on, the deal falls apart and you get the chance to get 2nd dibs on the house before it goes BACK on market.. Make sense? Happy Hunting :) !

By Jason Pacheco

•

24 Feb, 2023

In real estate, when a homeowner wants to sell their home, they typically call a real estate agent to come assist them with their sale. During the process, anytime the seller has a question, they will call the real estate agent that they hired to discuss their real estate needs with their chosen, trusted agent. SO, When a buyer wants to buy a house. They too should pick up the phone and call a real estate agent to help them buy a home. During the process anytime the buyer has a question, they too should call the agent they hired to assist them with their real estate needs. Simply, a seller has 1 real estate agent representing them, and a buyer shopping should only have 1 real estate agent representing them. If a seller has questions about anything on the market, they will discuss it with their agent. If a buyer has questions about a home they too see online, they should only discuss and contact their chosen agent too. Another thing to add, Every agent in Rhode Island has the same homes for sale. For example, Sally has the same homes for sale as to what Tommy has for sale. We are ALL working from the same inventory! I hope this makes sense. For more info, send me an email! Jason.Pacheco@CBrealty.com

All Rights Reserved | Pacheco Homes

Real estate agents affiliated with Coldwell Banker are independent contractor sales associates and are not employees of the company.

© 2022 Coldwell Banker. All Rights Reserved. Coldwell Banker and the Coldwell Banker logos are trademarks of Coldwell Banker Real Estate LLC. The Coldwell Banker® System is comprised of company owned offices which are owned by a subsidiary of Realogy Brokerage Group LLC and franchised offices which are independently owned and operated. The Coldwell Banker System fully supports the principles of the Fair Housing Act and the Equal Opportunity Act.

© 2024

Web Services: LevelUP Digital Solutions