Blog

Selling Your Home Starts With Knowing What It’s Really Worth If you’re a homeowner in Cumberland, Cranston, Smithfield, Lincoln, North Providence, or Johnston, Rhode Island , and you’re thinking about selling, one question always comes first: “What is my home worth?” The answer isn’t a Zestimate. It’s not a guess. And it’s definitely not what your neighbor’s house sold for last year. As a top local real estate agent specializing in seller representation , my job is to give homeowners a true, data-driven property valuation and a clear strategy to sell for top dollar , not just sell fast. Why Choosing the Right Listing Agent Matters in Today’s Market Selling a home in Rhode Island is no longer “put it on MLS and wait.” Buyers are more educated. Interest rates fluctuate. Inventory changes street by street. That’s why homeowners across Northern Rhode Island and Greater Providence work with an agent who understands: Local neighborhood pricing (not just town averages) Buyer demand in your specific area How to price strategically to create leverage How to protect sellers during inspections and negotiations I represent sellers—not transactions. What Is a CMA (Comparative Market Analysis)? A Comparative Market Analysis (CMA) is the foundation of a successful home sale. It answers: What homes like yours are actually selling for How long they’re taking to sell Where buyers are pushing back on price What pricing strategy will maximize your net proceeds A proper CMA is customized—not automated. How I Determine Your Home’s True Market Value When homeowners ask “What’s my home worth?” , here’s what I analyze: 1. Recent Sales (Not Just Active Listings) Active listings show what sellers want. Sold homes show what buyers will pay. 2. Micro-Location Within Each Town Pricing varies dramatically between: Different neighborhoods in Cumberland East vs West Cranston North Smithfield borders Lincoln school districts Johnston vs North Providence lines 3. Property Condition & Improvements Renovations, layout, lot size, utilities, and mechanicals all matter—sometimes more than square footage. 4. Current Buyer Demand Are buyers competing? Hesitating? Negotiating harder? This changes monthly—and directly impacts value. Why Online Home Value Estimates Are Often Wrong Zillow, Redfin, and other automated tools do not : Walk your home Account for upgrades Understand local buyer psychology Adjust for street-level differences That’s why many sellers: Overprice and sit Underprice and leave money on the table Lose leverage during inspections A local expert CMA prevents this. Seller Representation Built Around Results As a full-time real estate agent representing sellers , my approach is: Accurate pricing from day one Professional photography and video Aggressive marketing across MLS, online platforms, and private networks Strong negotiation to protect your bottom line Clear communication from start to finish Whether you’re selling: A starter home A move-up property A luxury or high-value home An inherited or estate property The strategy changes—but the goal stays the same: maximize your result . Selling a Home in Cumberland, Cranston, Smithfield, Lincoln, North Providence or Johnston? Each town has its own pricing patterns, buyer demand, and selling strategies. That’s why local experience matters. I help homeowners: Understand their true home value Decide if now is the right time to sell Create a smart pricing and marketing plan Navigate inspections, offers, and negotiations confidently There’s no pressure—just clear information and professional guidance. What Is My Home Worth? Get a Free, No-Obligation CMA If you’re even thinking about selling, the smartest first step is knowing where you stand. 📍 Serving: Cumberland, Cranston, Smithfield, Lincoln, North Providence, Johnston, RI 📊 Request your personalized Comparative Market Analysis 📞 No obligation. No pressure. Just real data. Knowing your home’s value puts you in control—whether you sell now or later.

When Rhode Island homeowners search for the top realtors in Cranston, Smithfield, Cumberland, Lincoln, or North Providence , they’re usually looking for one thing: someone who delivers a smooth, stress-free real estate experience backed by strong communication and proven results. In competitive markets across northern Rhode Island, having an experienced agent who understands pricing, negotiation, and marketing can be the difference between a frustrating process and a successful sale. If you’re researching the best real estate agents in these cities, here’s what truly sets a top performer apart — and why more buyers and sellers are turning to agents with a track record of client satisfaction, market expertise, and clear communication . Why Experience Matters in RI Real Estate Homes in Cranston, Smithfield, Cumberland, Lincoln, and North Providence have unique market trends, neighborhood pockets, and buyer demand cycles. A top realtor in these areas understands: Local inventory levels and price movement What upgrades attract the highest ROI How to position a home to stand out in competitive markets How to navigate contingencies, inspections, and negotiations smoothly Experienced agents are able to anticipate challenges before they arise , ensuring each transaction moves forward without unnecessary delays or surprises. Clear Communication = Smooth Transactions One of the biggest frustrations homeowners mention online is poor communication. The top realtors in Cranston, Cumberland, Lincoln, Smithfield, and North Providence all share one trait: 🔹 They communicate early, often, and clearly. That means: Updates at every stage of the process Transparency around pricing strategies Fast responses to calls, texts, and emails Guidance before, during, and after the sale Smooth transactions don’t happen by accident — they happen because the agent keeps everyone aligned, informed, and confident. Client Satisfaction: The Real Benchmark of a Top Realtor Search any review platform and you’ll notice the same pattern: The best real estate agents consistently earn high ratings for: Professionalism Negotiation skills Market knowledge Problem-solving ability Stress-free experiences Whether it's selling a high-end home in Cumberland, navigating multiple offers in Cranston, or helping a buyer find the perfect property in Smithfield or Lincoln, top agents focus on making the process as seamless as possible . Client satisfaction comes from doing the job right — and doing it well. A Realtor Who Gets the Job Done In today’s market, sellers and buyers want an agent who: Knows how to price accurately Markets strategically across digital platforms Handles challenges calmly and effectively Negotiates strongly while protecting client interests Keeps the transaction organized from start to finish The top realtors in Rhode Island don’t just list homes — they deliver results , and they do it while maintaining professionalism, communication, and trust. Working With a Local Expert in Cranston, Smithfield, Cumberland, Lincoln & North Providence If you’re searching for the best realtor near you in any of these Rhode Island communities, choosing a local expert with a proven track record is key. From luxury properties to first-time homeowner sales, an agent who understands these specific markets can guide you through a truly smooth, no-stress experience. Whether you're planning to sell, buy, or simply explore your options, partnering with an experienced, communication-focused realtor ensures your goals are met — and your expectations exceeded.

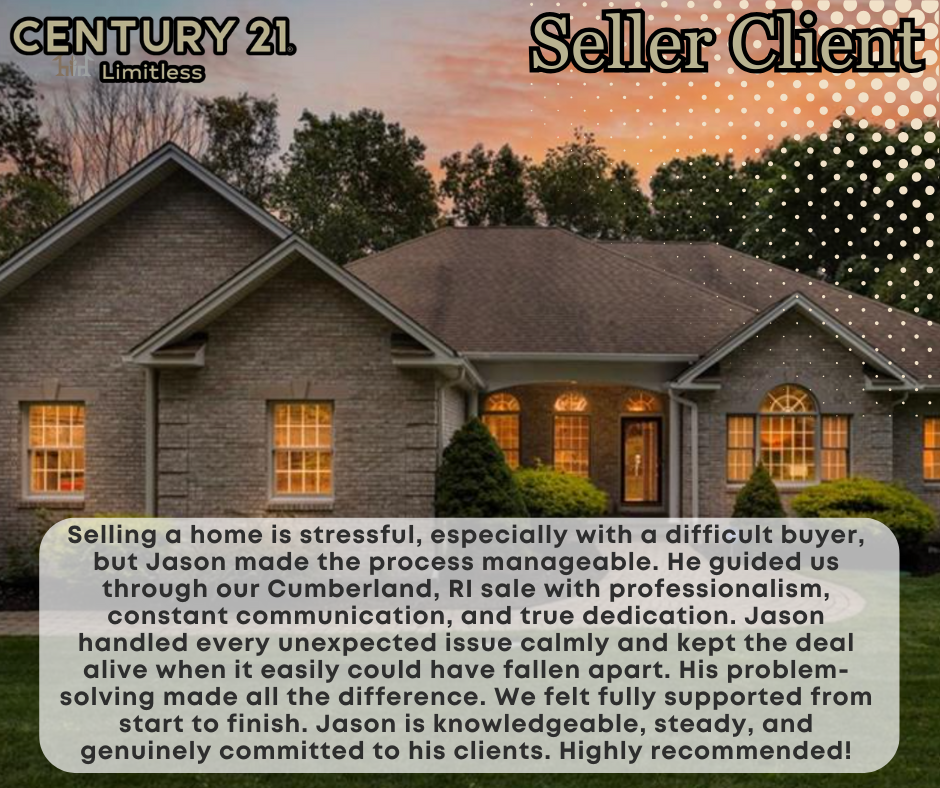

Representing Rhode Island’s most desirable homes with precision, negotiation strength, and white-glove service. Rhode Island’s high-end real estate market demands a different level of strategy, marketing, and execution. As a top-producing luxury Realtor® specializing in Cumberland, Cranston, Johnston, Smithfield, and Lincoln , I help sellers and buyers navigate one of the most competitive segments of the market with confidence and clarity. From modern estates in Cumberland , to executive-style properties in Cranston and Johnston , to private luxury homes in Smithfield and Lincoln , I bring a concierge-level approach designed to protect your equity, elevate your property’s presentation, and deliver exceptional results. ⭐ Why Luxury Sellers Choose Jason Pacheco Unmatched Local Expertise Decades of combined experience in these markets allow me to price strategically, negotiate powerfully, and anticipate challenges before they arise. High-End Marketing That Sells Every luxury listing receives: Professional cinematic video tours Drone photography Premium staging guidance Targeted digital and social media advertising (RI + MA buyers) Database exposure to hundreds of pre-qualified buyers Elite Negotiation & Transaction Management High-end transactions often involve complex terms, multiple decision-makers, and unexpected hurdles. My role is to remove friction, solve problems, and protect your best interests from start to finish. 💬 Real Review From a Luxury Seller in Cumberland, RI Sold a $800K+ home in a challenging transaction “Selling a home is stressful enough, but selling to a very difficult buyer is an entirely different challenge. Jason guided us through the sale of our home in Cumberland, RI with professionalism, expertise, and a level of dedication that went far beyond what we expected. He handled every unexpected issue with calm confidence, communicated with us constantly, and worked tirelessly behind the scenes to keep the deal moving forward. There were multiple moments when the sale could have fallen apart, but thanks to Jason’s persistence and problem-solving, everything ultimately came together. We felt fully supported throughout the entire process and truly could not have done it without him. Jason is the kind of agent you want in your corner — knowledgeable, steady, and genuinely committed to his clients. We are incredibly grateful and would recommend him without hesitation.” This review illustrates exactly what high-end clients in Cumberland, Cranston, Johnston, Smithfield, and Lincoln can expect—relentless representation, clear communication, and a smooth experience even when the deal becomes difficult. 🏠 Buying or Selling a High-End Home in Rhode Island? Whether you’re preparing to sell a luxury home or searching for a high-end property, I bring the strategy, systems, and network required to help you win in today’s market. 📲 Call or text Jason Pacheco – Century 21 Limitless Your Local Luxury & High-End Real Estate Specialist

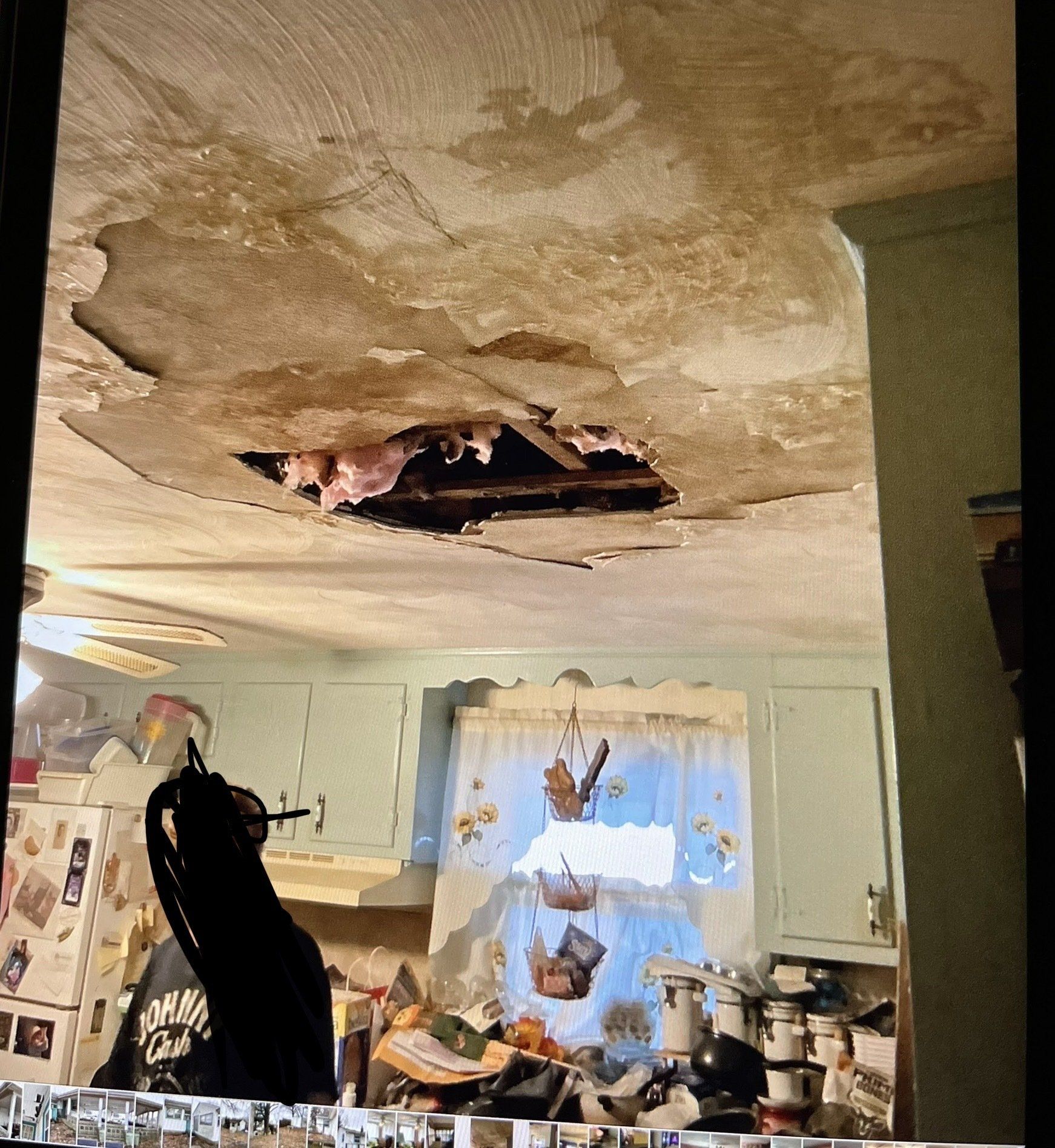

Option 1: List Your Home for Maximum Market Value For homeowners in Cumberland, Cranston, Lincoln, Coventry, North Providence, Johnston, and West Warwick , listing your home with a local real estate professional can help you reach thousands of active buyers. We’ll: Professionally market your home online and across social media. Handle all showings, negotiations, and paperwork. Help you get top dollar while keeping the process smooth and stress-free. If you’ve made updates or your home is in great condition, listing may be your best way to maximize equity. Option 2: Sell As-Is for Cash and Walk Away Need to move fast or don’t want to deal with repairs, cleaning, or showings? We also work with local cash buyers who purchase homes in any condition — occupied or vacant. You can: Skip costly repairs and inspections. Avoid cleaning or emptying the property. Close on your timeline — sometimes in as little as 7–14 days . No commissions, no hidden fees, no surprises. Just a straightforward way to sell and move on. Why Rhode Island Sellers Choose Us As a trusted local real estate resource serving Cumberland, Cranston, Lincoln, Coventry, North Providence, Johnston, and West Warwick , I understand each community’s unique housing market. Whether you want a fast cash offer or a full-service listing , I’ll walk you through every step with honesty and local expertise. Thinking about selling? 👉 Get your free home value estimate or instant cash offer today. Call or text Jason Pacheco – Century 21 Limitless to discuss your best option for selling your Rhode Island home.

If you live in Cumberland, Cranston, North Providence, Smithfield, Lincoln, West Warwick, or Coventry , you’ve probably noticed how quickly homes are moving off the market. As a local Rhode Island Realtor® , I’ve been helping families across these towns list their homes, attract the right buyers, and secure strong offers—even in today’s shifting real estate market. Whether you’re downsizing, relocating, or just curious about your home’s value, here’s what you need to know: Why Work With a Local Rhode Island Realtor? Selling a home isn’t just about sticking a “For Sale” sign in the yard. It’s about strategy. As a Rhode Island real estate agent who specializes in the Blackstone Valley and West Bay areas, I bring: Local expertise – Every neighborhood in Cumberland, Cranston, and North Providence has unique buyer demand. I help sellers price strategically to attract serious buyers without leaving money on the table. Marketing that works – Professional photography, video tours, and targeted online marketing ensure your home stands out to buyers in Smithfield, Lincoln, Coventry, and West Warwick —and beyond. Negotiation experience – Multiple offers? Contingencies? Inspection hiccups? I handle the details so you can focus on your next move. What’s Happening in the Market Right Now Low Inventory – Rhode Island continues to experience fewer homes for sale compared to buyer demand, especially in Cumberland and Cranston . This creates a competitive environment for sellers. Strong Buyer Activity – Even with interest rates fluctuating, serious buyers are still ready to move—particularly in family-friendly towns like Smithfield, Lincoln, and Coventry . Seasonal Shifts – Traditionally, fall and early winter see lower inventory, meaning sellers in North Providence and West Warwick face less competition. Thinking About Selling? Here’s Your First Step If you’re curious what your home might sell for in today’s market, I offer a free, no-obligation home valuation . Within a few minutes, I can give you insight into: Your home’s estimated market value How long similar homes in Cumberland, Cranston, Smithfield, and Lincoln are taking to sell What buyers are looking for right now in your area Let’s Talk If you’re in Cumberland, Cranston, North Providence, Smithfield, Lincoln, West Warwick, or Coventry , and you’re even thinking about selling—let’s connect. The sooner you know your options, the better you can plan your next move. 📲 Call/Text me at [your number] 📧 Email: [your email] 💻 Or request your free home valuation right here on my site. Selling your Rhode Island home doesn’t have to be stressful. With the right Realtor® by your side, it can actually be exciting.

1. Inventory Is Still Tight in Rhode Island In towns like Cumberland and Smithfield, available homes are consistently below what’s considered a “balanced” market. That means sellers often benefit from strong demand. Buyers are still competing for well-priced properties, especially those that are move-in ready. 2. Pricing Matters More Than Ever Yes, it’s still a seller’s market in many areas — but overpricing can backfire. In places like Cranston or Lincoln, buyers are savvy and watching interest rates closely. If your home is priced right, it can attract multiple offers. If it’s priced too high, it may sit longer and end up selling for less. 3. Neighborhoods Have Unique Appeal Cumberland : Known for top schools and suburban appeal, inventory moves quickly when priced correctly. Cranston : A mix of urban and suburban living, highly desirable for commuters. Smithfield : Strong community feel with newer developments drawing attention. Lincoln : Central location and sought-after neighborhoods make it a consistent market. Coventry : Larger lot sizes and more affordable options pull in first-time buyers. West Warwick : Attracts both investors and homeowners looking for value. Each market has its quirks, which is why a local opinion matters. 4. Preparing Your Home Makes a Difference Small updates like fresh paint, new light fixtures, or simple landscaping can have a big impact on how quickly your home sells. Buyers in Rhode Island markets still pay a premium for homes that feel “ready.” 5. Timing Follows the Seasons The Rhode Island market typically peaks in late spring through early fall. That said, motivated buyers search year-round, especially in tight-inventory towns like Cumberland and Smithfield. Listing in winter isn’t a deal-breaker — but strategy is everything. The Bottom Line: Is Now the Time to List? If you want an honest, no-pressure opinion about your home’s value and whether it makes sense to sell right now, the best step is a personalized consultation. Every home and every seller’s situation is different, and the decision shouldn’t come from a generic market headline. Ready for an Honest Conversation? If you’re in Cumberland, Cranston, Smithfield, Lincoln, Coventry, or West Warwick , I’d be happy to give you a straightforward market analysis — no sales pitch, just real numbers and advice.

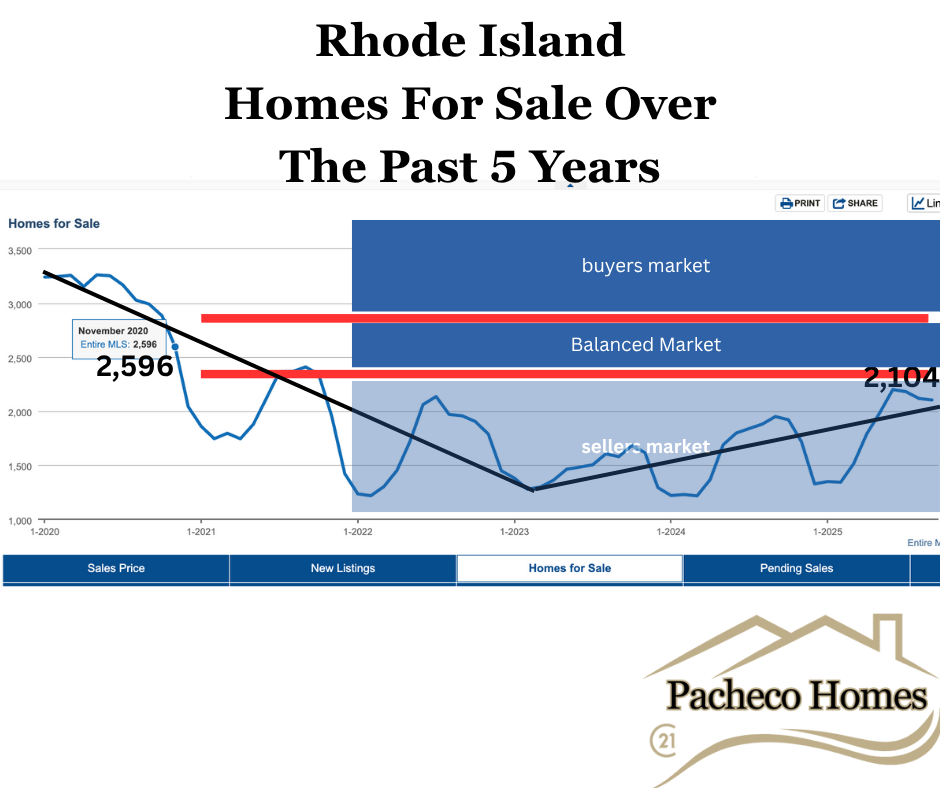

The Rhode Island Association of Realtors recently released housing inventory data, and it paints a clear picture of where our real estate market has been—and where it’s going next. In my opinion, anything under 2,596 homes for sale in Rhode Island means we’re in a seller’s market. And if you look closely, we’ve been stuck in seller’s market territory since 2021. Seasonal Housing Trends in Rhode Island Like much of New England, the Rhode Island housing market follows a predictable seasonal pattern: July–October : The most homes for sale, as inventory peaks. November–February : Listings drop off sharply, hitting the lowest point in January and February. March–June : The spring real estate market builds momentum, pushing inventory back up until the summer months. This cycle—up in the summer, down in the winter—has always been the natural rhythm of housing supply in Rhode Island. What’s Changed Since 2023 The most interesting trend is what started in late 2023. For the first time since the COVID-19 housing shortage , inventory has been steadily climbing. In fact, by August 2024 , Rhode Island had more homes for sale than at any point since 2022. That’s a strong sign that we’re finally climbing out of the post-COVID low-inventory crisis. My 2025 Housing Market Predictions Based on this trajectory, I believe: 2026 will likely continue the path to a balanced market. P rovided interest rates hold steady. If rates remain unchanged for the next 5 years, inventory will likely keep climbing, eventually pushing Rhode Island toward a more traditional buyer’s market —similar to what we knew before COVID. It’s important to remember: the bidding wars and waived inspections that became common after COVID were historically rare. The Wild Card: Interest Rates There is one big variable that could change everything: mortgage interest rates . If rates fall below 5% and stay there for six months straight, it could trigger another wave of buyer competition and pull us back into a stronger seller’s market. The Bottom Line The Rhode Island real estate market in 2025 is shifting away from the COVID-era frenzy and toward more stability. Buyers, sellers, and investors should watch inventory levels closely in the coming year—because they’ll be the key to knowing whether Rhode Island stays balanced or swings back into another competitive cycle.